Here at The Drone Girl, we talk a lot about investing in drone companies. But how are drone companies themselves investing the funds they have? German-based analytics firm Drone Industry Insights sought to find out how drone companies will prioritize how they spend money in 2024 — and the answer certainly isn’t hardware or software development.

‘Marketing and sales’ is the leading priority amidst drone companies for the next 12 months, at least according to DII’s 2023 Global Drone Industry Survey. That survey was created based on online survey responses from 1,113 drone industry participants across 85 countries, and was released in August 2023 by DII.

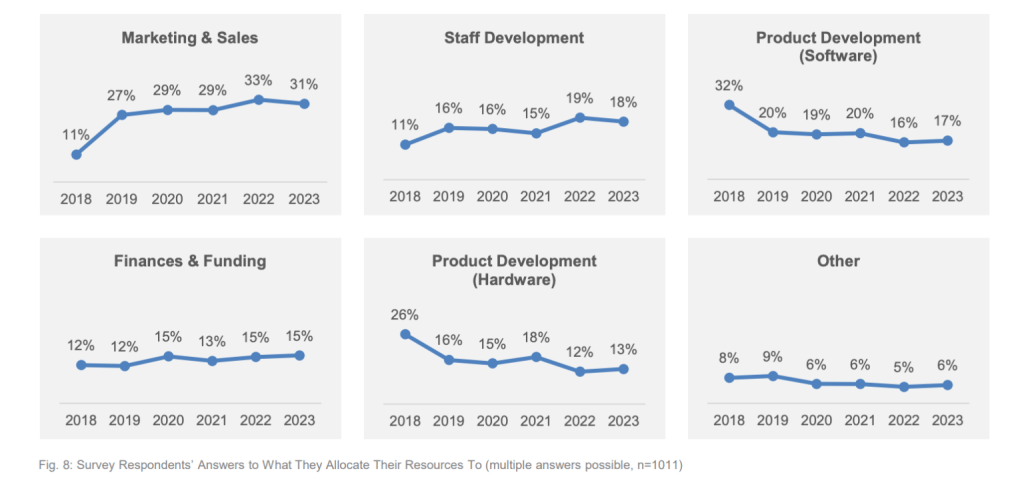

As part of the survey, DII asked respondents to state their priorities regarding resource allocation, with six possible options: marketing & sales, finances & funding, staff development, hardware development, software development, and other (e.g. international expansion, enhancing drone operations, fostering business development). Note that respondents could select multiple answers.

Ultimately, 31% of respondents selected marketing & sales. Meanwhile, only 17% selected software development, and 13% selected hardware development as areas where they will primarily spend money in 2024

Here’s a breakdown of spending areas that drone companies are prioritizing this year, in order from most to least:

- Marketing & sales: 31% (down from 33% in 2022)

- Staff development: 18% (down from 19% in 2022)

- Software development: 17% (up from 16% in 2022)

- Finances and funding: 15% (unchanged since 2022)

- Hardware development: 13% (up from 12% in 2022)

- Other: 6% (up from 5% in 2022)

According to DII, that interest in prioritizing finances toward marketing has in fact tripled since 2018. In a similar survey conducted by DII last year, the results were also relatively similar, with 33% of companies prioritizing market & sales spending, just 16% prioritizing software development, and 12% selected hardware development — all figures within one or two percentage points.

Why are companies spending money on marketing in 2024?

So why are so many drone companies prioritizing spending money on marketing in 2024? One of DII’s theories is simply because the drone industry has matured enough to the point where now they simply need to advertise and sell their products and services rather than develop more of them.

And for what it’s worth, there is no shortage of sophisticated hardware and software already existing in the market. That includes everything from powerful mapping software to impressive follow-me drones. Formerly camera drones have evolved into robust, industrial powerhouses, such as the Sony Airpeak S1, which was built by Sony initially to carry its Alpha series of cameras. In that example, in April 2023 Sony launched some critical updates to its drone that included adding an RTK GNSS system for centimeter-level accuracy.

And while DJI still dominates, there are plenty of other up-and-coming competitors, particularly when it comes to American drone companies within the commercial space. With all those companies comes the need for each one to differentiate their unique selling points — which is primarily done through communications and marketing.

Interestingly, the number two spending area for drone companies is staff development. It’s not enough to be a good drone pilot with a Part 107 certificate these days. As the landscape grows competitive, companies are looking to hire experts in areas like precision mapping, modeling and photogrammetry — as well as folks who might not even get close to drones day-to-day but are pros in other aspects of business.

But to circle back to that idea that very little emphasis is being placed on hardware and software lately, it’s a compelling point. According to DII’s report, emphasis on product development has been slashed in half since 2018. Four years ago, hardware and software were the key spending areas for a plurality of drone companies, with marketing only taking 11% of the key focus.

Here’s a look at how all those spending areas have changed over the past six years, based on DII’s gathering of information of that survey question every year of its report:

Receive more insights from the 2023 Drone Industry Barometer by reading the full report here, available free for download.