Disclaimer: This article has been a living document since early February and was last updated on May 2, 2024, which means that previous versions of this article may differ from this final version below.

No topic has arguably sparked more imagination and media buzz in the world of Travel and Mobility Tech over the past ten years than air taxis, also known as eVTOLs, eSTOLs, or eCTOL, depending on the respective aircraft type and use case in mind.

We at the Lufthansa Innovation Hub have long closely followed every development in the emerging Advanced Air Mobility (AAM) sector. In 2021, this culminated in producing major research reports like:

- Our flagship eVTOL patent analysis,

- a comprehensive visual mapping of the entire AAM ecosystem,

- and an interactive dashboard tracking every venture capital dollar being invested in AAM companies around the world.

Since then, our research focus on AAM has slowed down a bit given slower funding dynamics since 2022, but as we fully edge into 2024, our outlook on the AAM market is becoming much more optimistic again.

The AAM Revival: Four Signs of Takeoff

There were essentially four major developments in the AAM sector in recent months that have reignited our research interest and convinced us that it’s time to dive deep into this market once again.

1. Joby Aviation’s Certification Milestone: Joby Aviation has recently achieved a significant leap in the Federal Aviation Administration’s certification process, completing the second of five stages. This critical progress signals Joby’s steady path toward potentially introducing air taxi services by as early as next year.

2. Major Strategic Alliances Are Forming: The end of 2023 and the start of 2024 brought exciting partnership announcements from eVTOL innovator Lilium. Collaborations with our parent company Lufthansa Group and Frankfurt Airport spotlight the growing interest and potential groundwork being laid for eVTOL operations in one of the world’s pivotal markets, indicating serious intentions toward operational readiness and infrastructural support.

3. Historic Debut Flight in NYC: Joby Aviation’s successful execution of New York City’s inaugural electric air taxi flight on November 12, 2023, stands as a landmark event. Taking off from Manhattan’s Downtown Heliport, this was not only a first for the city but also showcased the Joby S.4’s capability in an urban environment, paralleled by Volocopter’s similar feat, illustrating a significant step toward urban air mobility.

4. Ehang’s Regulatory Triumph: At the tail end of 2023, Ehang emerged as the first AAM company globally to receive a Type Certificate for its EH216-S model from the Civil Aviation Administration of China. This certification for its unmanned eVTOL aircraft paves the way for Ehang to embark on passenger-carrying commercial operations next.

Motivated and inspired by these events, we’re excited to launch an extensive research series into the AAM landscape which will last for at least the next six months, starting today!

Our goal?

To truly analyze the state of AAM in 2024, meaning decoding the sector’s readiness for commercial eVTOL operations and pinpointing areas that still need further development for the industry to truly take off.

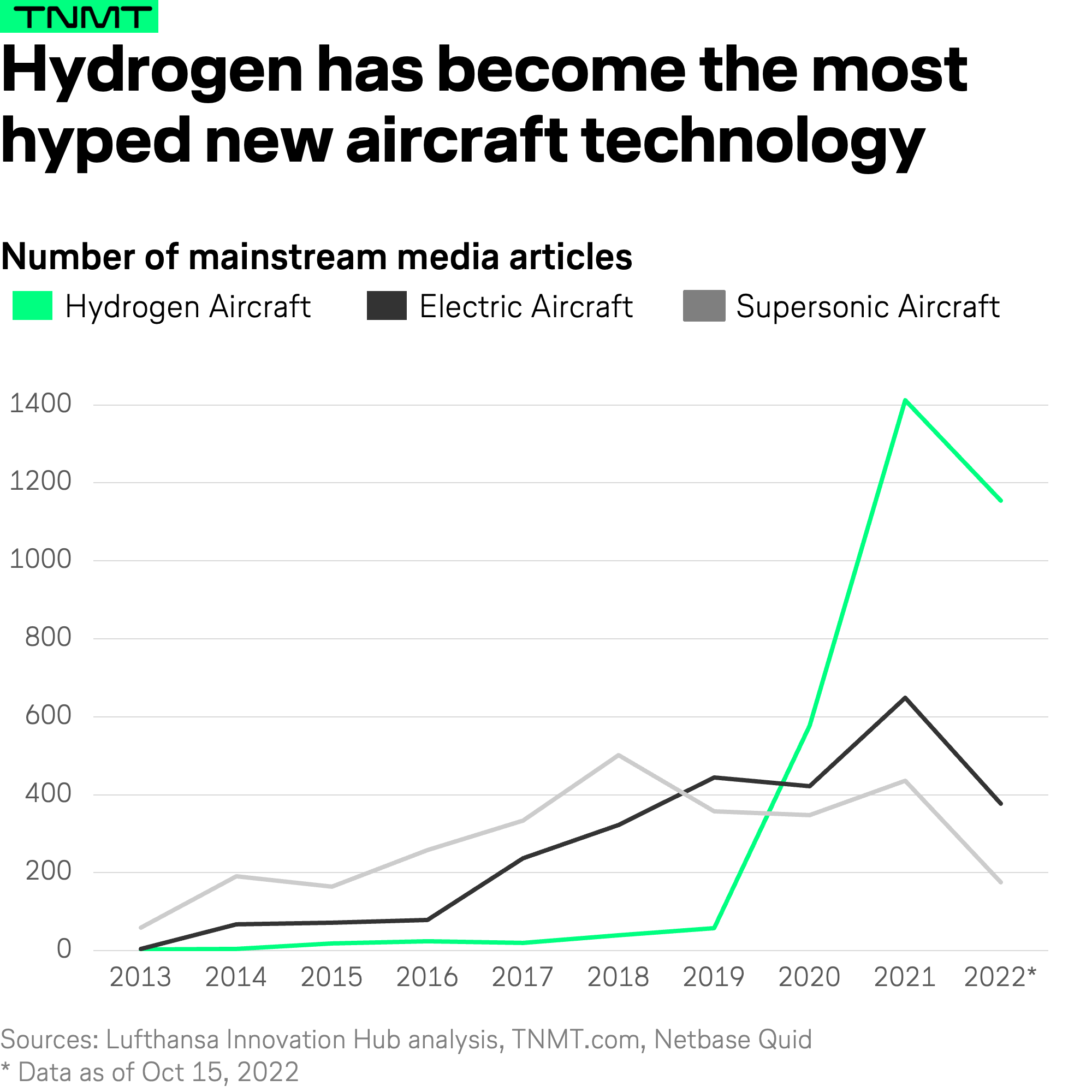

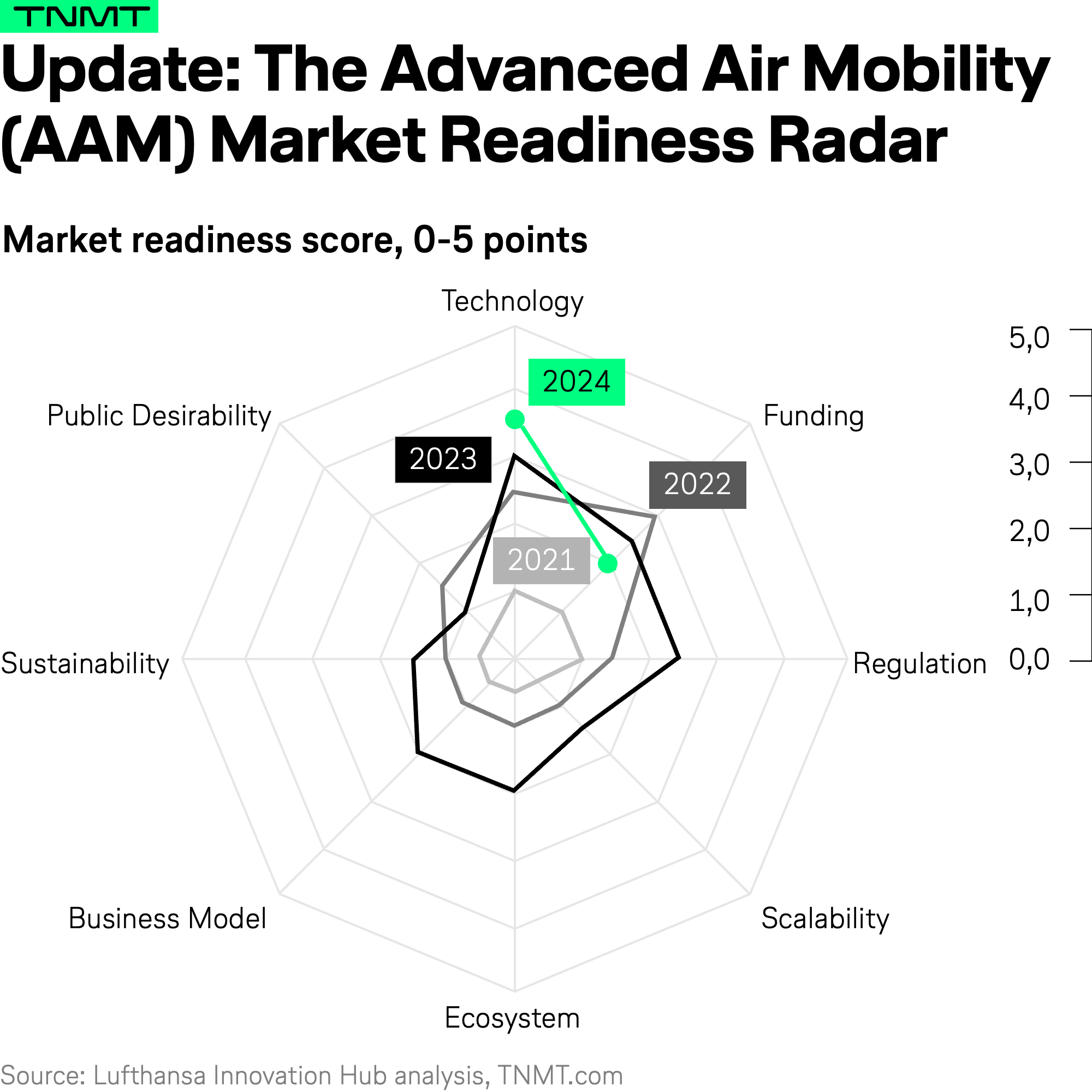

To achieve this, we crafted a new research product that we coined the Advanced Air Mobility Readiness Radar.

It’s a comprehensive yet pragmatic framework designed to evaluate the industry across multiple dimensions.

Unveiling the AAM Market Readiness Radar

The AAM Market Readiness Radar emerges as a straightforward tool for visualizing the journey toward the commercial viability of the AAM sector. This spider mapping instrument scrutinizes the essential factors crucial for the AAM industry’s success, particularly focusing on the transition from prototyping to commercialization.

- The tool is structured around eight key dimensions, each a critical pillar in assessing the industry’s preparedness for launching commercial AAM services in the future.

- These dimensions are evaluated on a scale from 1 (indicating areas needing significant work) to 5 (signifying readiness for commercial operations).

Here is what this looks like:

Let’s briefly define each dimension for more context:

Technology: This dimension is the backbone of AAM, spotlighting advancements in aircraft design, propulsion systems, avionics, and autonomous technologies necessary for AAM’s success.

Funding: This category assesses the financial stability and strategy of AAM startups, crucial for securing long-term viability through various funding avenues, including venture capital, corporate investments, or public offerings.

Regulation: This area navigates through the complex regulatory landscape, ensuring that AAM innovations align with safety standards and obtain the requisite certifications from authorities like the EASA, FAA, and CAAC.

Scalability: Focusing on the operational readiness of AAM services, this dimension evaluates production capacity, supply chain management, fleet operations, and the infrastructural foundation necessary for scaling AAM operations.

Ecosystem: This variable centers on cultivating the infrastructural and community ecosystem essential for AAM, including vertiports, maintenance facilities, air traffic management, as well as ground mobility integration.

Business Model: This dimension delves into developing sustainable business models and identifying strategic routes and use cases that can effectively market AAM technologies and ensure commercial viability.

Sustainability: Highlighting the environmental ethos of AAM, this area emphasizes eco-friendly technology development, emission and noise reduction, and the overall environmental impact of AAM services.

Public Desirability: The final category gauges public acceptance and enthusiasm for AAM, underscoring the importance of building public trust, securing community support, and aligning with stakeholders and city officials for successful AAM deployment.

AAM Readiness: Charting the Path Forward

Over the next few weeks, we’ll dissect each of the eight dimensions that determine the sector’s readiness for commercialization, based on the current landscape in 2024.

This evaluation aims to offer a comprehensive understanding of the industry’s progression and its readiness to transform urban and regional air mobility into a commercial reality.

Without further ado, let’s start with the first dimension: the technological backbone of the AAM sector.

In simple words, we’re diving deep into R&D progress, scrutinizing how far technology has evolved, especially when drawing comparisons with past years.

(1/8) The State of Technology

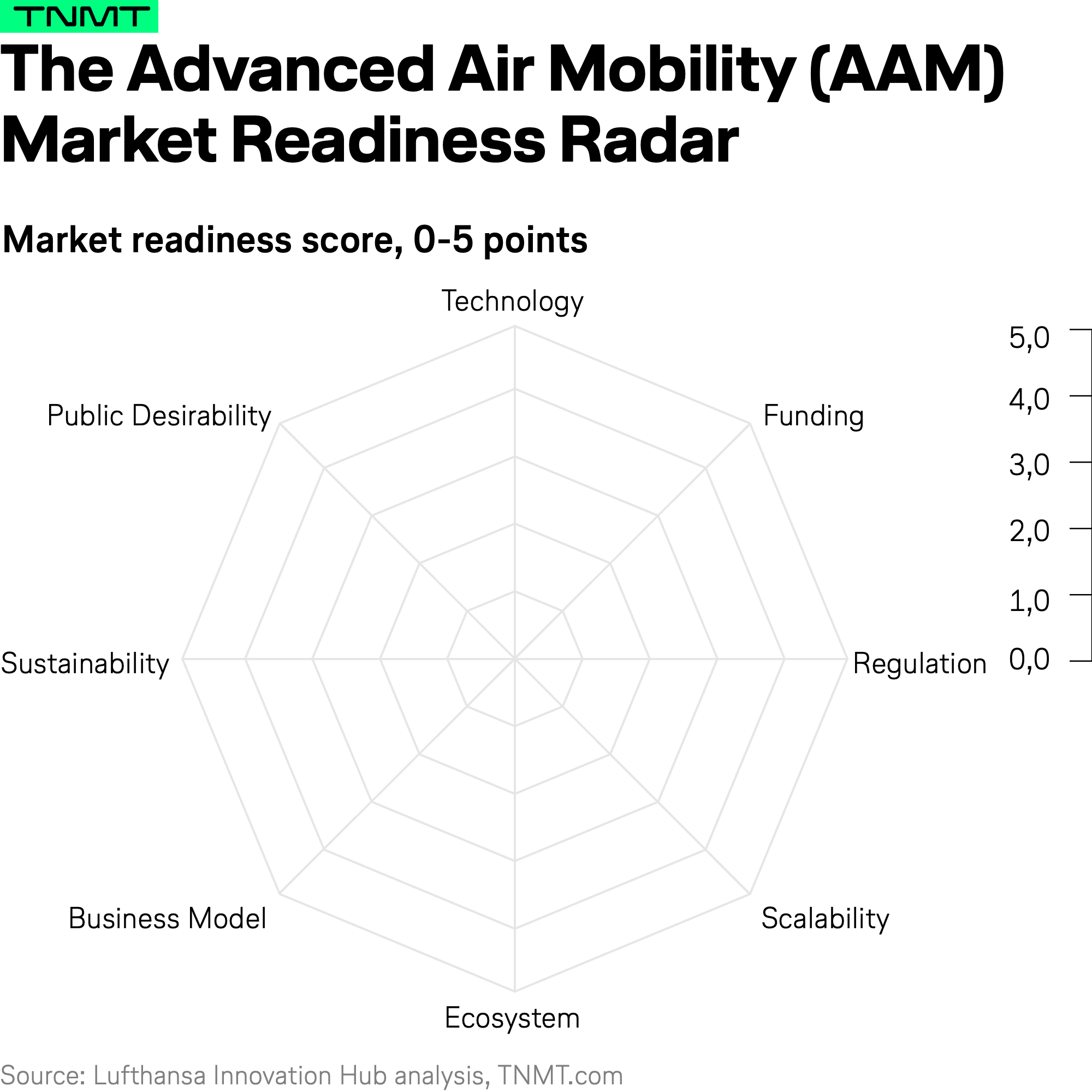

In our journey to dissect the current technological landscape of Advanced Air Mobility, we embraced a familiar yet potent analytical approach: the study of patents, similar to our 2023 patent analysis of the airline industry.

This approach is supported by numerous scientific studies highlighting patents as a reliable barometer for gauging the intensity and direction of technological innovation within any field.

Recognizing their importance, we delved into the patent filings of all major AAM contenders, drawing on our history of employing data-driven research methods to surface trends and insights.

Patent Activity: Signs of Exponential AAM Innovation

Delving into the patent filings within the Advanced Air Mobility sector reveals an intriguing narrative of innovation and ambition.

- Over the last 14 years, the AAM industry has mostly shown a steady and linear increase in patent activity.

- However, in the past two years, the sector has gone through a remarkable surge.

- In 2023 alone, the industry hit a milestone with an unprecedented 760 patent filings, setting a new record.

This massive surge in patent filings serves as a strong indicator of the AAM sector’s accelerated phase of innovation, unlike anything we’ve observed previously.

This development is not just noteworthy; it’s a sign of promise, aligning with our assessment that the industry is currently gaining momentum at an unparalleled pace.

The interpretation of this dramatic increase in patent filings is clear:

- AAM companies are eagerly safeguarding their R&D breakthroughs.

- This rush to patent filing is a testament to the sector’s technological advancements and a signal that the industry is moving closer to the reality of commercial AAM operations.

- As companies increasingly protect their intellectual property, it also underscores the growing competitive landscape of the AAM sector and the critical importance of securing a potential technological leading edge.

The race toward commercialization seems to be heating up, but let us further dive into where most of this patent filing activity is coming from.

Unpacking the Geographical Innovation Hubs

The recent explosion in patent filings across the AAM sector unveils intriguing geographical trends that spotlight the regions driving the most innovation. The data since 2022 underscores a significant concentration of innovation efforts.

As the chart illustrates, the United States accounted for an overwhelming majority of patent filings.

- In 2022, 60% of all AAM patents originated from the U.S., a figure that impressively climbed to 71% by 2023.

- This increase not only emphasizes the U.S.’s leading role but also its expanding influence in the AAM domain.

On the contrary, China, while holding the second spot in terms of patent filings, saw its share halve from 16% in 2022 to just 8% in 2023. Europe, despite its rich aerospace heritage and the European Union Aviation Safety Agency’s (EASA) encouraging regulatory framework, also saw a decline, contributing to only 7% of the total patents filed in 2023.

This distribution highlights the U.S.’s increasingly dominant position in AAM technology. The dominance of the U.S. is not merely a reflection of its innovative capacity.

- There are also a larger number of AAM companies based in the country that benefit from a robust ecosystem of venture capital that is eager to invest in breakthrough technologies.

- Furthermore, a forward-thinking regulatory stance by U.S. authorities contributes to an environment conducive to rapid technological development and experimentation.

In contrast, Europe and China face more challenging economic conditions that have recently underperformed against expectations. Such economic headwinds have arguably led to a more cautious investment approach, potentially slowing down the pace of innovation and patenting activities among their AAM players.

Given this, the current trajectory suggests that the most groundbreaking technological advancements and collaborative opportunities in AAM are likely to emerge from the U.S.

Three U.S. Companies Lead in AAM Patent Filings

The dominance of the United States in the AAM sector is further underscored when examining the companies that are most active in patent filings.

Leading the charge are the U.S.-based companies Joby Aviation, Wisk Aero, and Beta Air. Together, they not only top the list of AAM entities with the highest number of patents filed over the last 15 years but have also shown remarkable activity in the last two years.

- Notably, Beta Air has been particularly prolific in 2023, filing more patents than any other company within a single year.

- Patent leader Joby Aviation, on the other hand, experienced a slight slowdown in its patent growth in 2023 compared to its historical performance.

The ranking reveals further interesting takeaways:

- Traditional industrial giants like Honeywell are also actively engaging in AAM innovation alongside dedicated AAM firms. This diversity underscores the wide-reaching interest and potential impact of AAM across various sectors, including automotive and technology.

- Lilium, ranking fifth and representing the forefront of European AAM innovation, significantly expanded its patent portfolio in 2023. This growth signals that European companies also possess the potential to develop substantial technological foundations in AAM.

- The increasing accumulation of patents within the sector suggests rising barriers to entry for newcomers, potentially concentrating future innovation among current market leaders.

Especially the latter insight underscores the growing significance of strategic alliances within the AAM sector. Emerging or smaller companies are likely to seek collaborations with established patent holders to leverage their essential technologies and avoid infringement issues. A prime example of this dynamic is the legal and subsequent collaborative relationship between Archer and Wisk Aero, a company with deep ties to Boeing.

- In 2021, Wisk sued Archer for patent infringement, highlighting the competitive nature of technology development in the AAM space.

- However, by 2023, the two companies had not only settled their lawsuit but also agreed to collaborate on specific technological areas, such as autonomy.

- This collaboration was further solidified by Boeing’s decision to invest in Archer after having more or less taken over the ownership of Wisk.

This turn of events illustrates the complex interplay between competition and cooperation in the AAM sector, where yesterday’s rivals can become today’s partners in a bid to accelerate technological advancements and market readiness.

Leading Innovation Areas in AAM

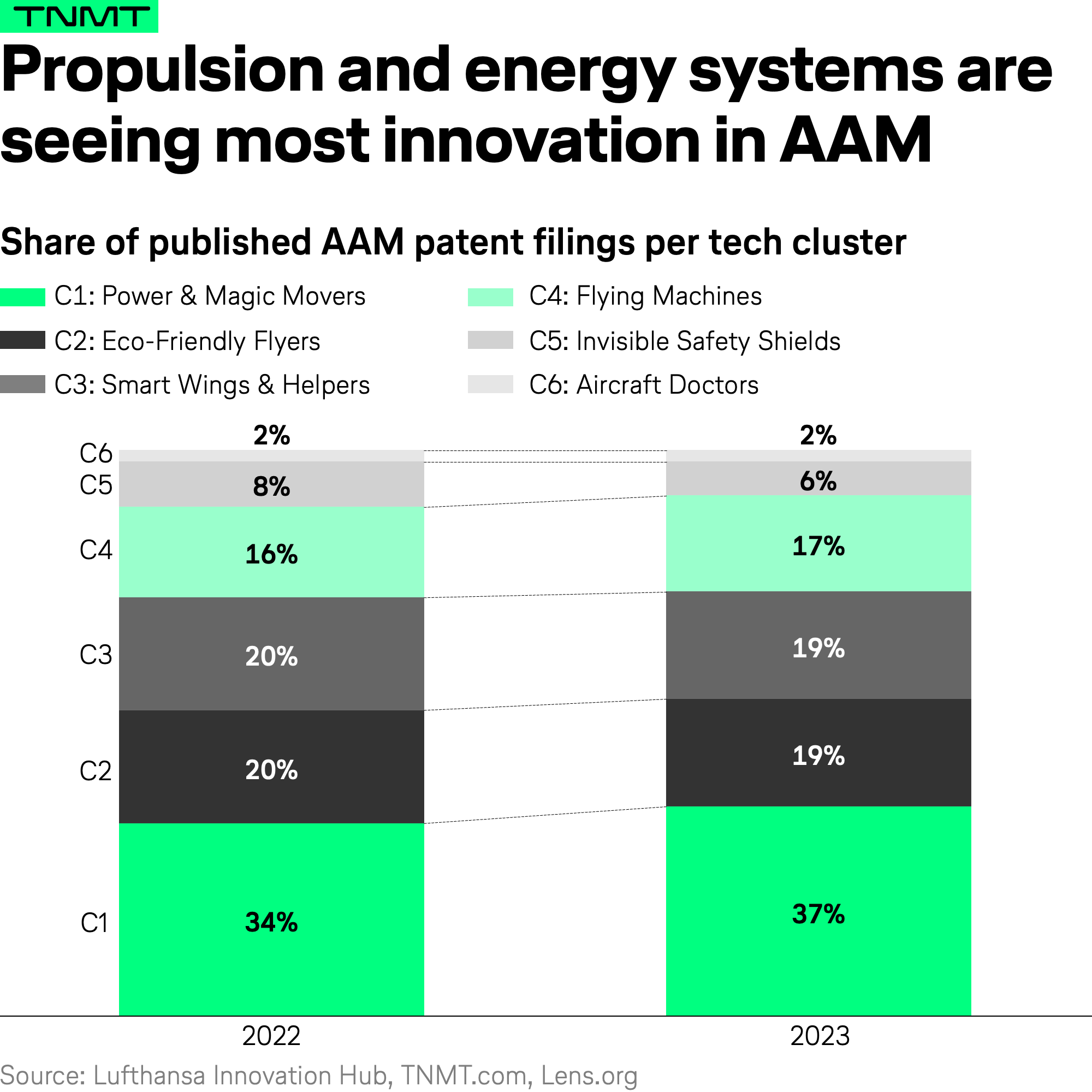

With a clearer picture of who the leading technology innovators are within the AAM sector, our attention now shifts towards the specific domains where these innovations are concentrated.

Analyzing the categorization of patents filed within the last two years sheds light on the technology areas most ripe for advancement in future eVTOL vehicles.

As the chart illustrates, the category known as “Power and Magic Movers,” predominantly focused on propulsion and energy systems, leads not just in the volume of patent filings for both 2022 and 2023 but also showcases the most significant uptick in intellectual property (IP) activities.

- The relentless pursuit of advancements in this area is driven by a fundamental industry mandate: without the development of electric propulsion technology that is not only efficient and quiet but also capable of achieving meaningful range, the vision of air taxis and their transformative impact on urban and regional connectivity simply cannot materialize.

- Given that the range of most eVTOL prototypes currently falls short of supporting any realistic longer-distance connections, such as intercity flights, the surge in patent filings here signals a strong push toward extending flight capabilities. In other words, it is a direct response to this critical bottleneck.

- Companies like Joby Aviation and Beta Technologies are at the forefront of addressing these challenges. This is crucial given that recent test flights have underscored the difficulty of extending range and flight time while maintaining power stability throughout the flight.

- Moreover, as urban areas are particularly sensitive to noise pollution, the push for quieter propulsion systems is also a direct response to one of the most significant barriers to public and regulatory acceptance of eVTOLs. High-profile tests conducted by companies such as Joby and Volocopter in densely populated cities like New York City, Paris, and Rome aim to demonstrate their aircraft’s ability to operate with minimal noise impact, an essential step toward gaining widespread acceptance.

- Lastly, the commercial viability of these aircraft hinges not only on their efficiency and range but also on the ability to quickly recharge or swap energy sources. Beta Technologies is pioneering in this area by developing a comprehensive charging network. Their efforts include partnerships with competitors like Archer Aviation, indicating a collaborative approach to overcoming one of the industry’s most pressing challenges.

Looking beyond propulsion and energy systems, the second most notable growth in patent filings is observed in the realm of “Flying Machines.”

- This cluster relates to the technology enabling the aircraft to perform its primary function—fly.

- Innovations in this category are crucial for improving flight stability, control systems, and overall airworthiness, making it a fundamental focus area for AAM companies aiming to enhance the safety and reliability of future air taxis.

- Notably, Beta Technologies stands out for its leadership in innovation efforts, particularly in the domain of in-flight stabilization.

The other areas of innovation, such as “Eco-Friendly Flyers” focusing on sustainability measures to minimize emissions, and “Core Aeronautic Technology” covering the essential elements of aircraft design and function, have maintained a consistent level of patent activity.

This consistency suggests that while these areas remain critical components of AAM technology development, they have not seen the same level of accelerated innovation as propulsion and flight control systems.

Scoring the AAM Technology Dimension

Reflecting on the diverse facets of patent activity within the AAM sector, it’s evident that the Technology Dimension has seen significant progress in 2024 compared to the previous year.

This advancement is underscored by a notable increase in overall patent filings, a clear regional focus with the United States leading the charge, and a concentrated effort from a select group of AAM pioneers.

The surge in patent activity, especially in the realm of propulsion technology, indicates a push towards extending the operational range of eVTOLs and maintaining power stability in-flight. This is a pivotal development, as enhancing travel distances directly impacts the feasibility of AAM services, creating viable business cases that (hopefully) offer real-time savings for passengers opting for air taxis over traditional ground transportation.

However, it’s also apparent that certain critical areas may require further attention and development.

- Notably, the relatively lower focus on safety and maintenance technologies might raise questions about long-term operational viability and passenger trust. However, it is important to note that despite comparatively lower patent activity, significant y-o-y growth in this area indicates a growing industry focus on safety. Collaborations and technology sourcing from aerospace veterans like Honeywell, which provides avionics to companies such as Lilium, underscore this commitment, even though it is not reflected in patent filing. Given the current landscape, the pursuit of a universally accepted safety standard for eVTOLs and other new air taxi models remains a work in progress. The European Union Aviation Safety Agency (EASA) is inclined towards adopting the stringent “10-9” safety standard, which would permit only one catastrophic failure per billion flight hours. Meanwhile, the US Federal Aviation Administration (FAA) is considering a more flexible approach. This variation underscores the ongoing dialogue and efforts within the industry to balance innovation with the imperative of safety.

- Another current white spot that rightfully raises some serious questions is the lack of emphasis on customer-facing digital innovations, such as the seamless integration of AAM services with existing ground-based mobility solutions, which suggests an opportunity for future innovation. Both of these elements are crucial for differentiating AAM services in a post-launch market where user experience and safety will play significant roles in determining success.

Given all these considerations, we score the Technology Dimension of the AAM sector as having made considerable progress but with room for further enhancements. The technology race within AAM is far from concluded.

Now, it’s time to pivot our attention to another critical aspect: the funding landscape.

(2/8) The Funding Environment

The AAM ecosystem’s funding environment is a vital determinant of its capacity to innovate, scale, and ultimately commercialize, due to the massive capital requirements needed to develop a new type of aircraft.

Without sufficient funding, bringing new AAM technology to life is nearly impossible.

Let’s take a closer look at the current funding environment from three different perspectives:

1. VC Flows into AAM: A Turbulent Journey

The Venture Capital funding landscape for AAM startups has been a roller coaster in recent years, reflecting broader VC trends yet amplified by the sector’s unique attributes.

- After peaking in 2021 with an impressive $7.7 billion USD across 121 deals, the following two years have seen a stark decline.

- In 2023, investments plummeted to $1.3 billion USD with just 46 deals, marking an 83% drop in funding and a 62% decrease in deal count from the peak.

How can this fluctuation be explained?

The investment frenzy in 2021 was primarily fueled by:

- An accelerating interest in electric flying and autonomous technology (driven by the autonomous automobile hype), with technological advancements generating a lot of hype. Examples include battery density improvements and new aircraft vehicle designs.

- A flood of “cheap money” through central banks combating pandemic-induced economic slowdowns ended up being invested in high-risk bets such as Advanced Air Mobility, ultimately leading to the SPAC bubble we explored before.

- A changing VC narrative shift towards investments in sustainability and climate-tech startups to accelerate the “decarbonization of everything.”

However, when the broader financial environment shifted — think of rising interest rates and inflation — Venture Capitals became a lot more cautious.

- The global economic slowdown shifted investor preference towards safer assets.

- The underwhelming market performance of several publicly traded AAM companies, compounded by delayed milestones, further cooled down investor sentiment.

- Ultimately, a growing awareness of the sector’s technological and regulatory hurdles slowed down over-optimistic timelines and market projections.

This shift in the macro environment poses significant challenges for the sector. AAM startups must now showcase much more concrete and short-term progress to attract new investments. Such essential developments include measurable technological innovations such as flight range improvements, regulatory achievements such as FAA clearances, or strategic alliances that lead to “unfair advantages” over its competitors, such as partnerships with airlines or collaborations with automotive firms to master manufacturing, to name just two examples.

Given the astronomical costs associated with aircraft development, certification, and scaling — often running into billions — the path forward for the industry will prove daunting. To put the capital needs into perspective, achieving certification for a new aircraft type is a monumental financial undertaking.

Drawing parallels from the commercial aviation sector provides further insight into the magnitude of these capital requirements:

- For instance, the development of Bombardier’s C-Series, an aircraft designed to carry between 110 and 135 passengers (similar to short-haul electric aircraft prototypes), necessitated an investment of approximately $6 billion USD.

- Similarly, the Embraer E-Jet E2 family, which wasn’t a completely new design but rather a significant upgrade of its predecessor, incurred development costs of at least $1.7 billion USD.

These examples highlight the extensive financial resources required to bring new aviation technologies to fruition.

As a result, the current investment climate suggests a looming consolidation within the AAM industry, with bigger players soon to take over a lot of their smaller peers who will be unable to compete in the new environment. Companies that can secure funding during this lean period are likely to emerge as sector leaders. No wonder investors are now favoring companies with a more transparent path to commercial success and regulatory approval, in line with our 2023 VC projection of “substance over hype.”

2. Identifying Wall Street’s Favorite AAM Contenders

The Advanced Air Mobility sector remains largely conceptual at this point, with actual commercial operations yet to materialize. This nascent stage of development makes it challenging to pinpoint the true frontrunners in the industry. No real-world operations means comparisons are often based on theoretical frameworks, prototypes, and envisioned services rather than tangible products or services.

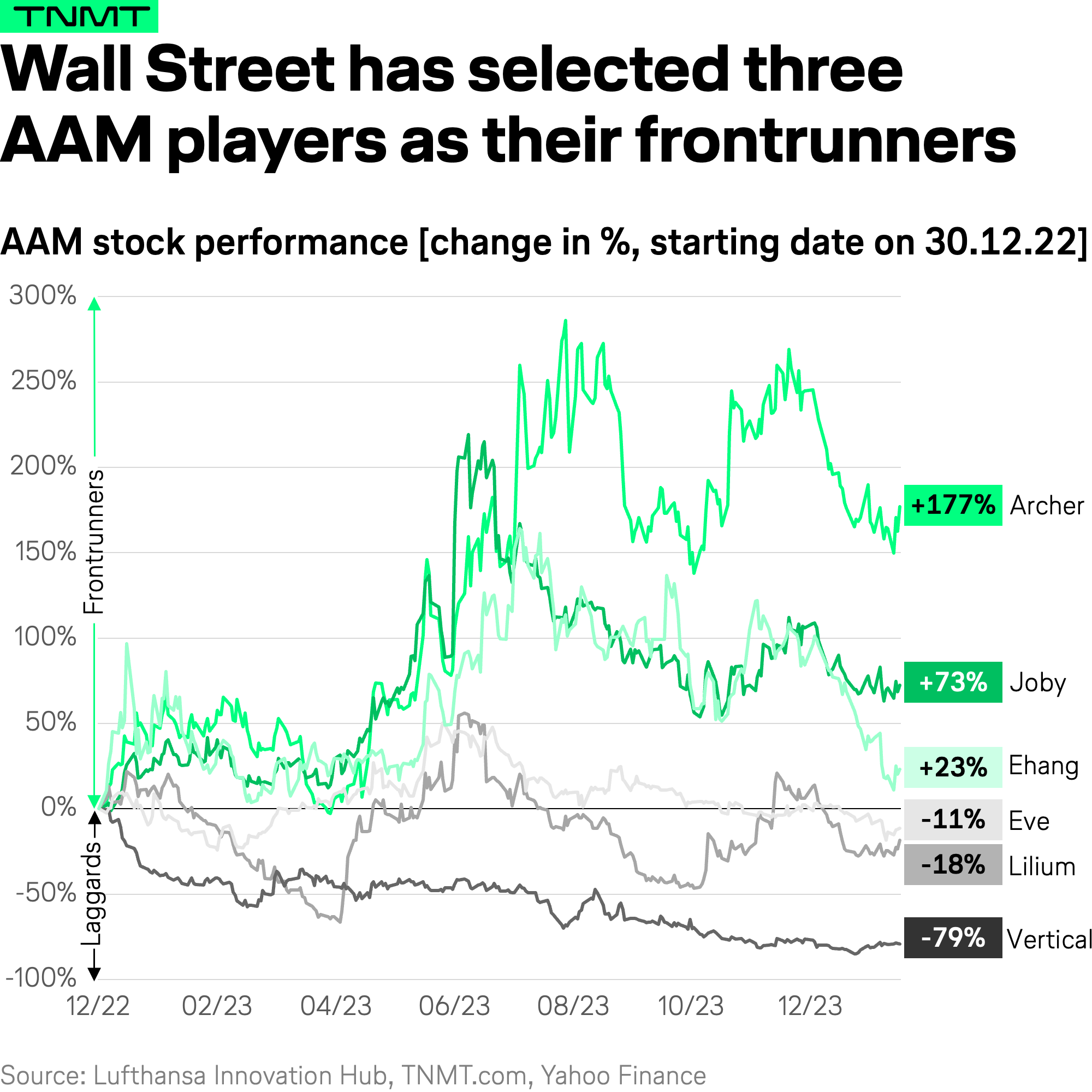

In this environment, one practical approach to assessing the progress and market sentiment towards the main AAM contenders is by examining their share price performance, at least for those that have ventured onto the public markets.

A look at the share price movements since the end of 2022 highlights the perceived momentum of various AAM companies.

- As illustrated in the chart below, Archer Aviation leads with a remarkable 177% increase in its share price, followed by Joby Aviation with a 73% rise, and Ehang, up by 23%.

- Meanwhile, Eve, Lilium, and Vertical Aerospace trail behind, with Vertical Aerospace experiencing a notable decline of 79%, Lilium dropping by 18%, and Eve seeing a decrease of 11%.

It’s essential to approach these figures with caution, as stock prices are inherently volatile. Nevertheless, these trends offer valuable insights into the current momentum within the AAM sector:

- Archer Aviation’s impressive stock growth could be attributed to several pivotal developments. These include its Part 145 certification from the FAA, the ramping up of manufacturing, its successfully perceived flight test program, and robust support from strategic investors.

- Joby Aviation has likely seen its stock bolstered by the completion of the third stage of the FAA certification process, announcements of strategic launch partnerships (e.g., with Dubai’s Road and Transport Authority), and ongoing investments from renowned companies.

- Ehang’s stock has benefited from its unique position as the only AAM company with a certified eVTOL aircraft, the Ehang 216, in the Chinese market, even though the design of the Ehang 216 is unlikely to receive approval from Western regulators like the EASA or FAA.

For the laggards, the reasons behind the stock price declines seem also traceable:

- Eve is navigating difficulties related to development timelines and additional funding, now turning to loans as its last resort.

- Both Lilium and Vertical Aerospace have encountered delays in their eVTOL developments. Furthermore, Vertical Aerospace faced setbacks due to an accident involving its prototype during a test flight.

While stock price movements shouldn’t be overinterpreted, they certainly provide a window into how investor sentiment is beginning to differentiate AAM contenders into perceived frontrunners, associated with optimism, and laggards, viewed more bearishly.

Companies meeting their promised timelines, achieving test flight successes, and securing regulatory approvals are rewarded by the market, whereas those falling short on these milestones lag behind.

Essentially, we’re witnessing the separation of the wheat from the chaff. As previously highlighted, this dynamic suggests a trend toward increased M&A activity, where stronger entities are likely to absorb the weaker ones. This consolidation aims to fortify market positions, acquire critical technologies, and integrate highly skilled teams.

3. Assessing Survival Runways

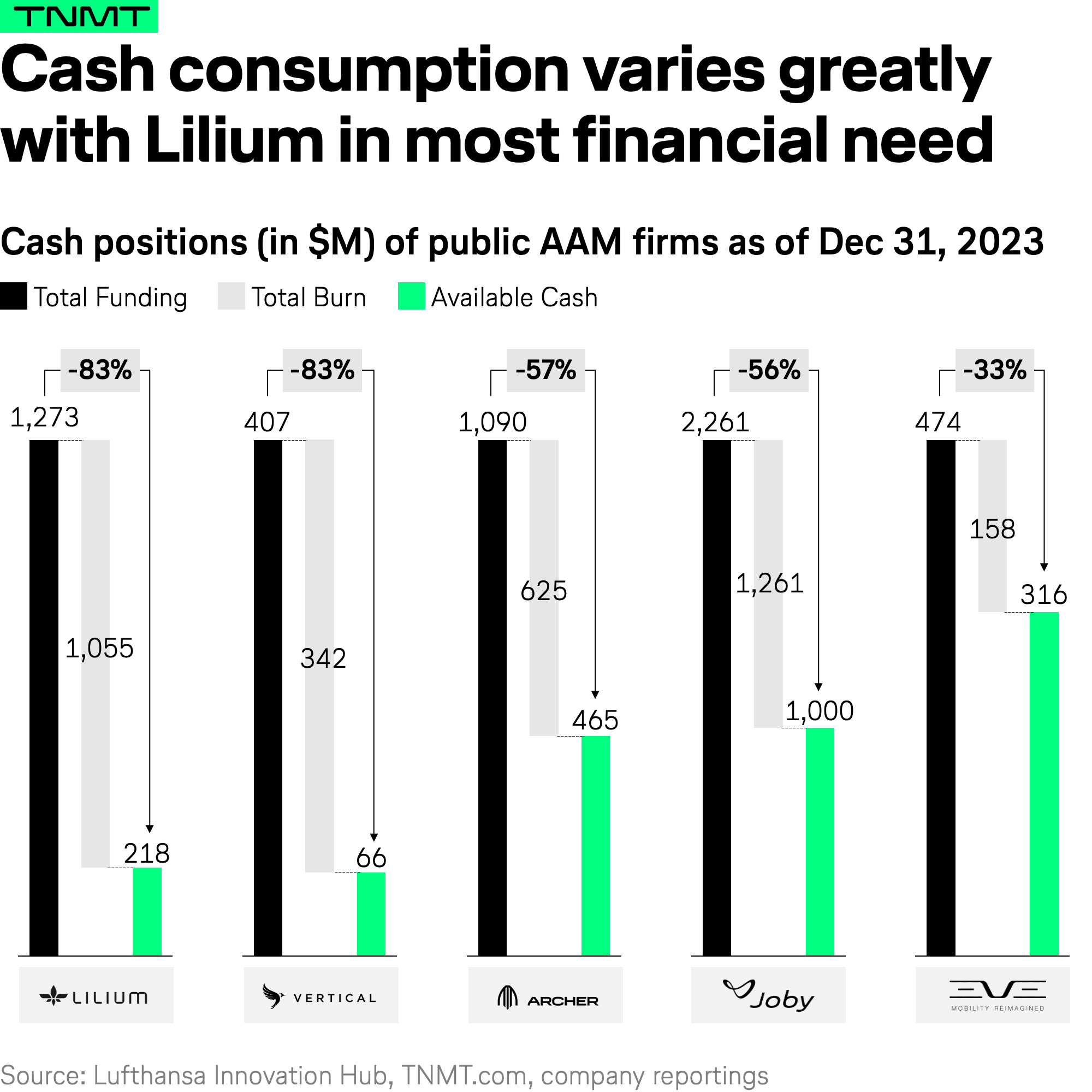

Transitioning from market sentiment, we shift our focus to a critical company characteristic that’s gaining much more prominence in this era of limited funding: the survival runway. This term refers to the duration a company can maintain its operations with its existing cash reserves without needing to secure additional capital.

To gain a clearer picture of the AAM’s financial stability, we examined the burn rates of the six publicly listed AAM firms relative to their historical fundraising. The burn rates, derived from the latest quarterly or annual reports, reflect the expenditure over the preceding quarter or year and serve as a basis for future projections.

This analysis reveals several key insights:

- Joby Aviation clearly appears as the frontrunner in terms of available cash, boasting a cash runway extending beyond 30 months, thanks to a series of successful follow-on funding rounds.

- On the opposite end of the spectrum, companies like Lilium and Vertical are facing a precarious financial situation, with less than 5 and 7 months of cash runway left, pushing them into urgent mode for new funding.

- Archer finds itself in a somewhat safer yet still cautious position, with a runway of approximately 12 months. This gives Archer some leeway but underscores the pressing need for additional funds to support ongoing development and eventual scaling. Its current global roadshow is a testament to this effort.

- Eve stands out for its defensive financial management, boasting a cash runway of about 36 months. This substantial buffer is a result of Eve’s cautious cash use, as we’ll explore further.

This comparison of cash runways is crucial but requires a nuanced perspective. While it’s essential for AAM companies to invest significantly in engineering and manufacturing to progress their eVTOL aircraft development, this is not the time for reckless spending.

Particularly concerning are companies heavily investing in sales and marketing, like extensive air show appearances, or general and administrative expenses without clear technical milestones. This raises efficiency questions if not strategically managed. It’s about finding the right balance: a) promoting the vehicle to attract future investments, while b) ensuring most efforts and resources are primarily focused on aircraft development. Unjustified spending on marketing and non-developmental activities cannot be afforded at this stage.

As a result, operational adjustments may also be necessary to cut burn rates, potentially scaling back on certain initiatives (e.g., Volocopter’s reduction in VoloIQ development or halting VoloConnect) or pivoting towards activities that could generate revenue now (for instance, Joby and Archer’s moves to engage with the defense sector).

For a deeper dive into how efficiently companies are using their funds, we’ve compared each company’s total cash consumption against the total funding they’ve received up to December 2023.

- As expected, Eve and Joby emerge as the most financially prudent, having utilized 33% and 56% of their received funding (incl. granted credit lines), respectively.

- Conversely, Lilium and Vertical are on thin ice with only 17% of their historical capital remaining. Their substantial fund consumption is linked to aggressive expansion strategies and, to some extent, higher operational costs—underscored by incidents like the loss of aircraft in accidents for both Lilium and Vertical.

All of this paints a clear picture: as the AAM industry navigates a challenging funding landscape, strategic financial management will be key. Those who strike the right balance between development focus and capital efficiency stand the best chance of weathering the storm and leading the sector into its next phase of commercialization.

Scoring the AAM Funding Dimension

With all this information in front of us, it’s time to score the current funding environment of the sector. Considering the constricted Venture Capital funding landscape, the varied stock performance of listed AAM providers, and the precarious financial standing of numerous significant companies, we’ve clearly observed a downturn in our total scoring for the Funding dimension compared to previous years.

As a result, we’ve adjusted our 2024 score from 2.5 to 2.0.

It’s clear: the industry is in urgent need of sustained financial investment. Without it, the AAM sector risks facing implosion.

What could lighten up investor sentiment going forward? Regulatory progress might be one component. We want to explore this category next.

(3/8) The Regulatory Status Update

The journey to realizing Advanced Air Mobility (AAM) extends well beyond securing the necessary billions for technological advancement. While achieving fully functional AAM vehicles like air taxis and electric aircraft marks a significant milestone in and of itself, these innovations still face the colossal hurdle of stringent aviation safety regulations before they can take off into operational reality.

The aviation sector, renowned for its rigorous safety protocols, rightfully demands comprehensive regulatory frameworks to ensure safety. As we delve into the state of AAM regulation in 2024, our focus shifts to understanding how emerging AAM technologies align with existing regulatory measures and what steps are necessary to integrate them into the global airspace.

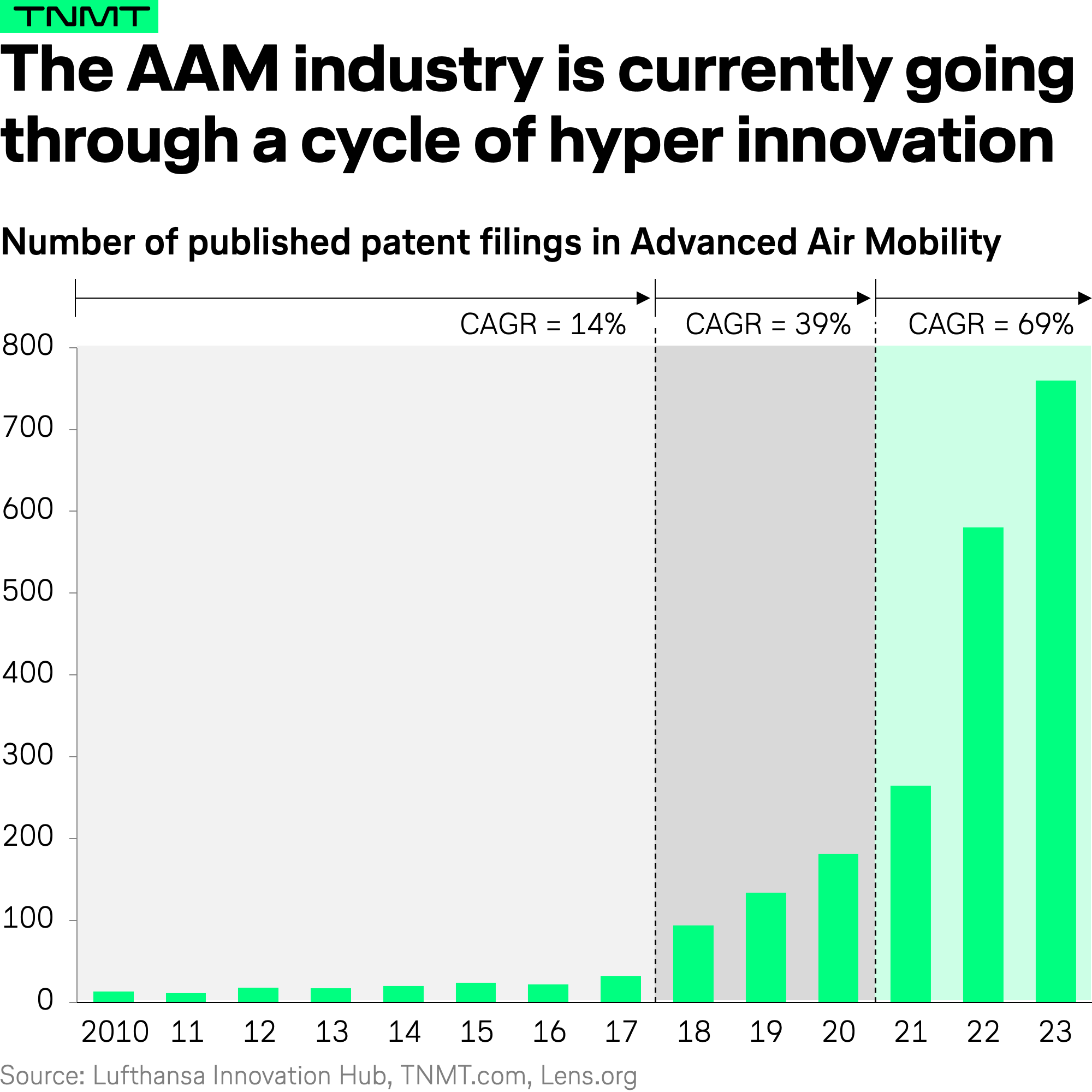

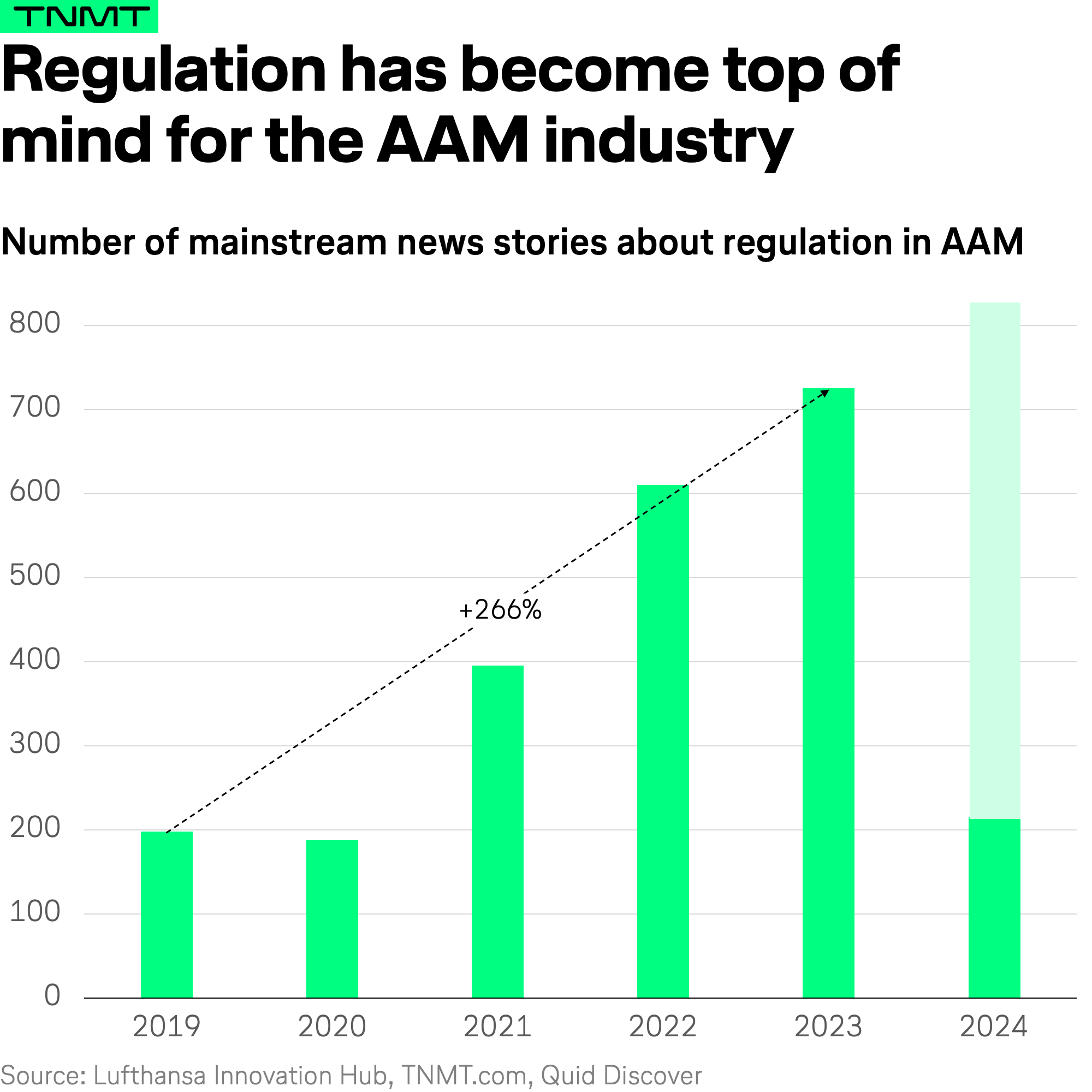

The Rising Regulatory Narrative For AAM

The increasing prominence of regulatory discussions in the media landscape clearly indicates that regulatory compliance and certification are now a pivotal concern for the AAM industry.

Over the past five years, media coverage related to AAM regulation has not only grown but is projected to hit a record high in 2024.

This surge has been largely fueled by the significant regulatory milestones that have been achieved by leading AAM contenders:

- Joby Aviation has recently completed three of the five stages of the type certification process, becoming the first Western air-taxi contender to reach this milestone towards commercialization.

- Archer is preparing for certification as it started building three type-conforming, piloted Midnight aircraft to be used in for-credit flight testing with the regulator, which is expected to begin later this year.

- Last but not least, Ehang, from China, has already secured full-type certification for its aircraft, which was issued by the Civil Aviation Administration of China.

Without a doubt, regulation and certification have become the center of attention for aspiring AAM contenders and the industry as a whole.

Regulatory Divergence in Advanced Air Mobility

More important than public attention is the actual progress on the regulatory and certification fronts. Today’s AAM regulatory framework is characterized by a varied landscape across major markets, including the United States, Europe, the United Arab Emirates, Singapore, and China.

Each region adopts unique strategies to integrate these new air mobility solutions into their airspace, urban infrastructure, and legal systems. We have synthesized these variations into a simplified comparative table to illustrate the differences clearly.

Synthesizing all these insights, here is how the different countries approach AAM regulation as of today:

China’s Comprehensive Approach

China’s regulatory framework is notably thorough, encompassing a broad spectrum of requirements. It addresses 10 specific regulatory aspects, including stringent certifications for aircraft and operators, detailed pilot licensing, and rigorous infrastructure approvals, particularly concerning vertiport construction and operation.

Leadership in the UAE and Singapore

The UAE, especially Dubai and Singapore, are at the forefront of the most advanced AAM regulatory frameworks.

The UAE’s regulations, including CAR-UAM and Law No. 04 of 2020, span all 15 aspects analyzed, showcasing its proactive stance towards becoming a global AAM leader.

Singapore’s regulations cover 14 of these aspects, embedded within its “Smart Nation” initiative, which seeks to leverage technology for enhanced urban mobility. Unlike many regions, Singapore does not differentiate between drones and UAM; instead, it treats all unmanned aerial systems (UAS) as part of a holistic new technology approach.

Cautious Strategies in the US and Europe

Both the United States and Europe take a more measured approach to AAM regulation.

The US is extending its existing helicopter transportation rules to include AAM, aiming for a smoother integration with current aviation systems.

Conversely, the European Union is working on a dedicated AAM regulatory framework to ensure harmonization with its existing air transport systems. This methodical approach may slow progress but is designed to minimize regulatory and operational discrepancies.

Given this scattered approach to regulation across major (potential) markets, we foresee several operational challenges for the AAM industry going forward.

- The lack of regulatory uniformity poses significant hurdles for global AAM operators. Adapting to diverse regional regulations will likely require specific aircraft designs or operational adjustments by country, complicating global scalability and compliance.

- Differing regulatory strictness reflects the varying levels of risk tolerance and safety cultures across regions. Regions with less stringent regulations might facilitate faster market entry but could also lead to inconsistent safety standards and potentially riskier operations, particularly concerning flight paths and operational limitations near residential zones.

AAM Companies’ Path to Market Readiness

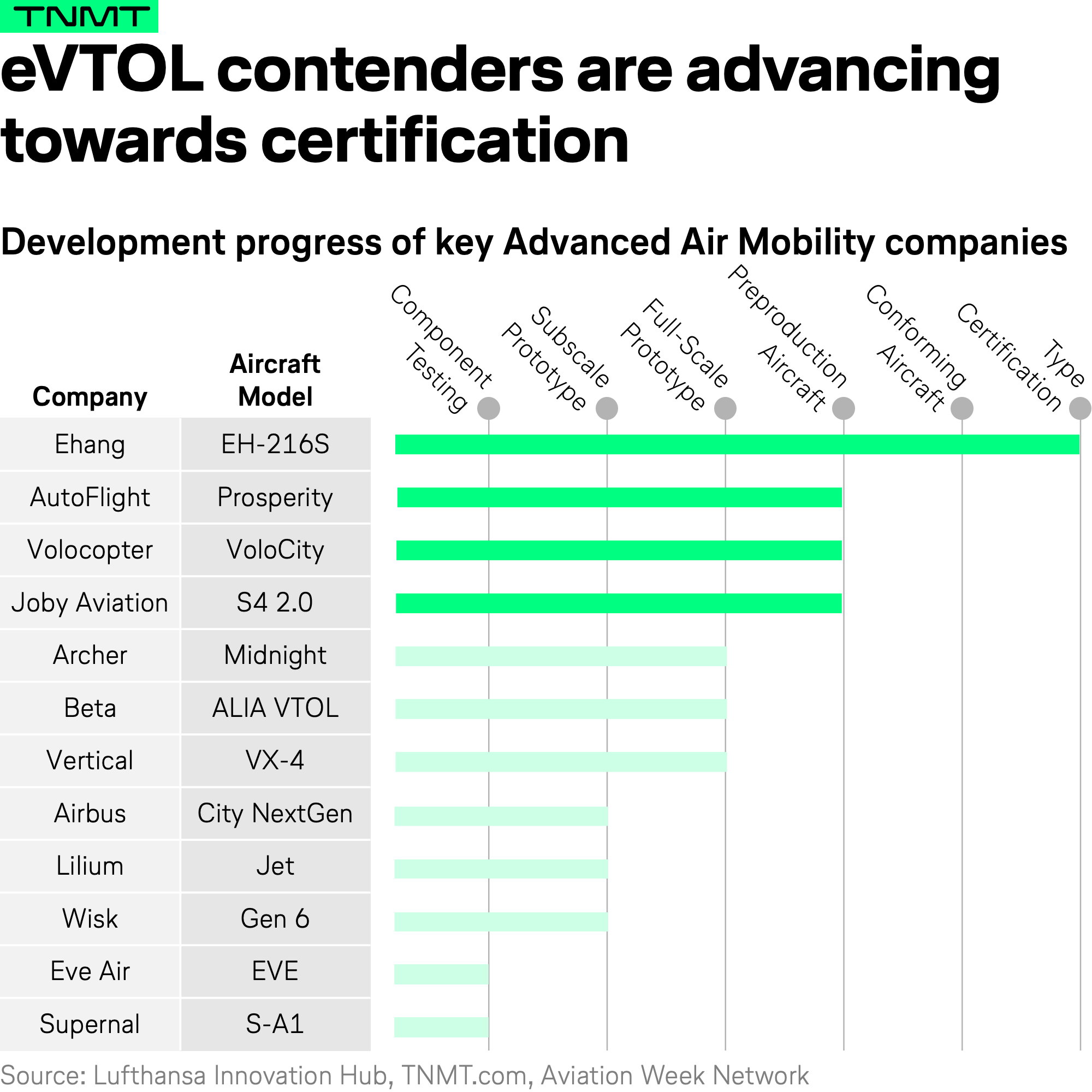

As we examine the certification progress of individual air-taxi contenders, it becomes clear that the journey to market readiness is varied and complex.

The certification ranking, illustrated in the chart below, reveals significant disparities among top players in the Advanced Air Mobility (AAM) sector.

China’s Ehang leads the race, having already secured full-type certification, as previously mentioned. This achievement positions the company at the forefront of the industry, ready to initiate real-world operations. Close on its heels are AutoFlight, Volocopter, and Joby Aviation, each on the brink of entering the type certification stage. This critical phase will test their readiness to meet stringent regulatory standards and prepare for commercial deployment.

Based on our understanding of the AAM ecosystem, the chart provides three additional key takeaways from our point of view:

- The ability to navigate through these certification stages is increasingly becoming a crucial factor for AAM contenders to secure additional funding. With investor sentiment shifting towards startups that demonstrate a clear timeline for market operations, progressing through certification is no longer just a regulatory requirement but a significant competitive edge.

- As these companies approach the final hurdles of certification, their success will heavily depend on their ability to engage with regulatory bodies effectively. This necessitates a deep understanding of regulatory frameworks and the ability to influence them, skills that may require AAM contenders to enhance their teams with regulatory and compliance experts.

- With Ehang already certified and others not far behind, the AAM industry is (finally) transitioning from speculative potential to actual market presence. This shift marks a long-aspired-to milestone where theoretical efficiencies and operational capabilities of air taxis will be tested under real-world conditions. The success of these early movers will set a precedent for the scalability of AAM solutions, paving the way for broader adoption and potentially reshaping urban mobility.

Scoring AAM Regulation Progress

Given all these considerations, we rate the Regulation Dimension of the AAM sector as having advanced compared to last year.

However, there is significant room for further enhancement. This assessment reflects the reality that only one company has reached Type Certification yet and that regulatory frameworks are still works-in-progress. Particularly, the absence of a globally uniform regulatory framework poses ongoing challenges.

As we observe these advancements, the next critical aspect to delve into will be “Scalability” — the fourth dimension in our AAM market readiness assessment.

Understanding how AAM technologies transition from prototypes to mass production is crucial for assessing their commercial viability and long-term sustainability.

Stay tuned.